The latest DA hike has brought much-needed financial relief to government employees and pensioners across India. With rising inflation, this increase directly improves monthly income and purchasing power. A higher Dearness Allowance means better salary structure for working staff and increased pension for retired employees. This update is especially important for middle-class families who depend on fixed income. Overall, the DA hike strengthens financial stability, boosts morale, and supports daily household expenses amid increasing costs of living.

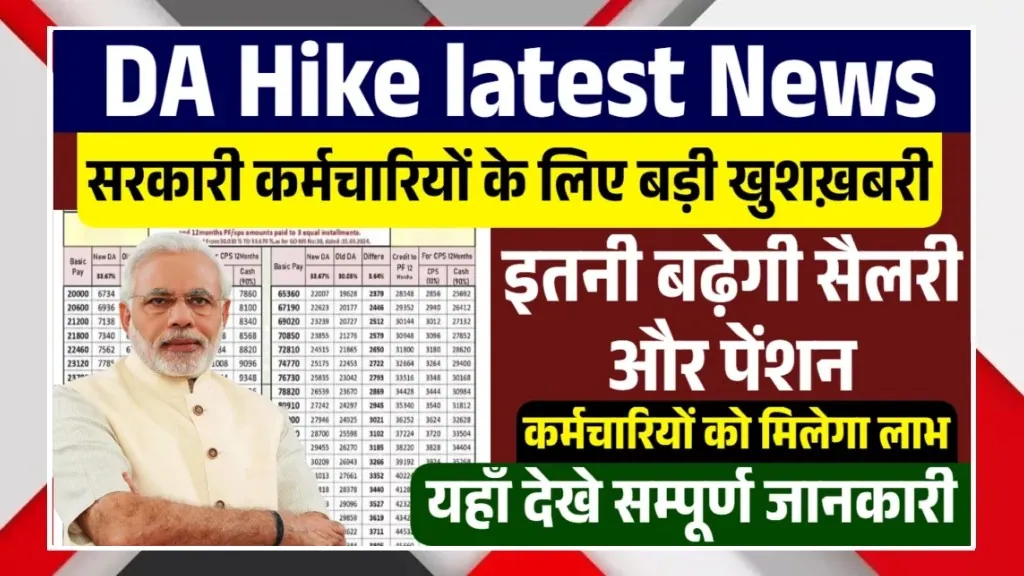

Highlight Table: DA Hike Impact Overview

| Category | Before DA Hike | After DA Hike |

|---|---|---|

| Dearness Allowance | 55% | 58% |

| Monthly Salary Impact | Lower | Increased |

| Pension Amount | Lower | Increased |

| Inflation Adjustment | Partial | Improved |

| Beneficiaries | Employees | Employees & Pensioners |

1. Salary Increase For Central Government Employees

The DA hike directly increases the take-home salary of central government employees. As DA is calculated on basic pay, even a small percentage rise creates a noticeable difference in monthly income. This helps employees manage rent, education, and daily expenses more comfortably. Over a year, the cumulative gain becomes significant, offering better financial planning and savings opportunities.

2. Pension Boost For Retired Employees

Pensioners also benefit equally from the DA hike through increased Dearness Relief. This rise is crucial for retired individuals who rely solely on pension income. Higher pension payments help them cope with medical costs, household bills, and inflation-driven price rises, ensuring a more secure and dignified post-retirement life.

3. Inflation Protection And Cost Of Living Support

Dearness Allowance exists to offset inflation, and the latest hike strengthens that purpose. With prices of essentials continuously rising, the increased DA helps balance purchasing power. Employees and pensioners feel less pressure from inflation, making daily life more manageable without cutting back on necessities.

4. Arrears And Financial Backlog Benefits

Along with the revised DA rate, eligible employees often receive arrears for previous months. This lump-sum amount provides immediate financial relief. Many use arrears to clear debts, pay school fees, or invest in savings, creating short-term financial comfort and long-term security.

5. Positive Impact On Employee Morale

A DA hike improves confidence and motivation among government staff. Feeling supported by timely financial adjustments increases job satisfaction and productivity. It reassures employees that their income is protected against economic changes, strengthening trust in government policies.

6. Long-Term Effect On Savings And Investments

Higher monthly income allows employees and pensioners to plan better savings. Increased DA can be redirected toward insurance, fixed deposits, or retirement funds. Over time, this improves financial resilience and reduces dependence on loans or external support.

7. Foundation For Future Pay Revisions

The DA hike also sets the stage for future pay commission benefits. A higher DA base positively influences upcoming salary revisions. This ensures that both current employees and pensioners continue to see gradual income growth aligned with economic conditions.